By 2026, the hot drinks market in Australia is forecast to be worth $4.6 billion with a compound annual growth rate (CAGR) of 5.4 per cent, the latest research from GlobalData finds.

Global Data said the market was valued at $3.6 billion in 2021, with the rising demand for health and wellness tea blends and herbal or fruit infusions, spurred by the pandemic, a large contributor to market growth.

GlobalData’s report, Australia Hot Drinks - Market Assessment and Forecasts to 2026, reveals that the hot drinks sector’s growth will be primarily driven by hot coffee, the largest category, while the other hot drinks category is set to register the fastest value CAGR of 5.7 per cent over 2021-2026.

The hot coffee and hot tea categories are predicted to record a CAGR of 5.5 per cent and 4.8 per cent, respectively, over the forecast period.

Nestlé, JAB, and Cantarella Bros were the top three companies in the Australian hot drinks market in value terms in 2021, and Nescafe and Moccona were the leading brands.

GlobalData consumer analyst Naveed Khan said hot drinks manufacturers, retailers, and foodservice operators were under pressure to raise prices to cover the rising input costs. However, the relaxation of the pandemic restrictions led to increased demand and consumer spending.

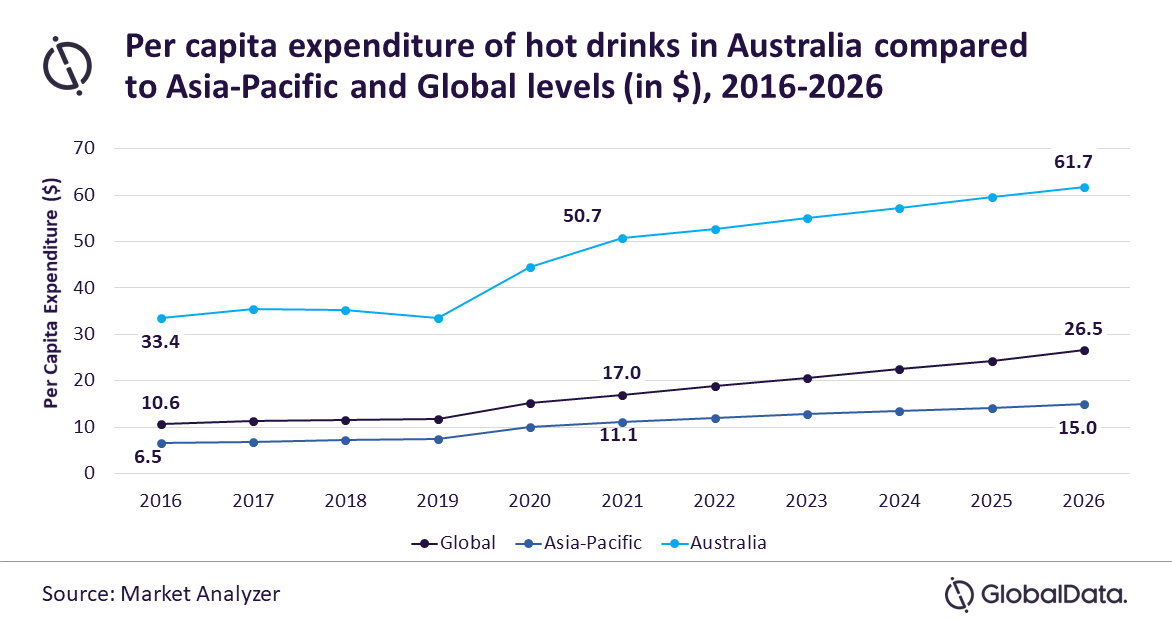

Consequently, the per capita expenditure (PCE) on hot drinks in Australia increased from $33.4 in 2016 to $50.7 in 2021, surpassing the regional level at $11.1, and the global level of $17. Australia’s PCE on hot drinks will surge to $61.7 in 2026, GlobalData said.

“Experimentative consumers are seeking new ways to enjoy hot drinks at home and out of the home. This is spurring the demand for specialty coffee, functional teas, and hot chocolate drinks. Concurrently, the increasing public outdoor mobility and reopening of offices and institutions is fueling the demand for instant coffee, coffee capsules, and tea bags,” said Kahn.

“With the easing of COVID-19 restrictions, the on-premise and on-the-go consumption of hot drinks is on the rise. However, prolonged inflationary pressure is compelling foodservice operators to raise prices. Manufacturers are launching new products with innovative brewing methods and distinctive flavors to attract the young consumers, who are willing to spend more for novel consumption experiences.

“Tea manufacturers are focusing on functional blends with immunity strength and mental relaxation claims to help consumers cope with the stress of the economic and health crisis. Hot drinks companies are also embracing sustainable packaging designs with low environmental impact to gain goodwill among eco-conscious consumers,” said Kahn.

According to the report, hypermarkets & supermarkets were the leading distribution channel in the Australian hot drinks market in 2021, followed by convenience stores and food and drinks specialists.