Food and beverage manufacturers and distributors are in focus in the latest edition of CommBank’s Manufacturing Insights Report, which examines emerging trends that are reshaping the dynamics of manufacturing, wholesale trade and transport distribution.

In her forward to the report, CommBank national manager Manufacturing & Wholesale, Maria Christina, says the following:

Welcome to the latest edition of the Manufacturing Insights Report. This builds on our previous Manufacturing Insights series, now providing visibility of market drivers and responses across the supply chain from production to customer delivery.

It has been developed to help decision-makers benchmark performance metrics and support forward planning as part of our ongoing commitment to provide data-led market intelligence.

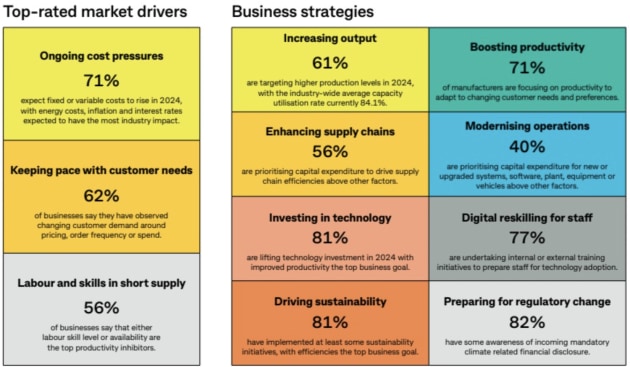

The report arrives at a time when we know manufacturers and distributors have again had to draw on their resilience. The research confirms that in the past 12 months, rising operating costs, changing customer expectations and labour shortages have tested many.

Even so, the research shows that most businesses have at least moderately increased production volumes and continued investing in 2023, ensuring operations remained agile, efficient, and productive. Capacity utilisation rates as a proxy for productivity also remain healthy.

That has created a strong foundation as many businesses again target steady growth in output and revenue in the year ahead. It is one reason why cautious optimism is evident across the industry.

While multiple hurdles remain that can constrain capacity and responsiveness, most businesses are undeterred. For many, that’s because the strategies they need to navigate top challenges are already underway.

This includes plans to streamline the supply chain, invest in modernising operations, reskill the workforce and adopt sustainable practices.

These also all have an overlapping goal to support higher productivity and build an edge in a competitive marketplace.

The report delves into the top challenges and tactics as businesses adapt to customer needs and seek new ways to optimise their operations and workforce. As you advance your strategies for the year ahead, we hope this report provides valuable insight into how your peers and supply chain partners plan to get ahead.

Key Insights

The report is based on a survey of 464 respondents, 115 of which were operating in the food and beverage sector. For the first time, the report combines decision-makers from both manufacturers and distributors to evaluate trends across the supply chain.

Fifth Quadrant conducted the online quantitative survey on behalf of the Commonwealth Bank between late January and the end of February 2024.

The sample was selected to ensure the results are nationally representative.

All statistics and references to manufacturers and distributors in this report are based on the responses to the survey unless otherwise stated.

It found manufacturers and distributors sought to build capacity and output, with many increasing capital expenditure (55 per cent) to support higher production volumes (60 per cent) and revenue (65 per cent).

Fewer could expand their teams amid labour shortages (45 per cent), particularly in regional areas.

Most manufacturers and distributors raised their prices (71 per cent) to offset rising costs. However, with profit rising for fewer businesses (63 per cent) and most only seeing slight increases, price increases were not enough to maintain margins in every case.

Looking ahead, this operational and financial performance is expected to continue.

There is tempered optimism across the industry, with 83 per cent of manufacturers and distributors expressing confidence in business conditions over the next year.

Of these, one in four are very confident. However, nearly one in five (17 per cent) are not optimistic. It shows sentiment varies between business types, locations and sizes.

Manufacturers are more confident than distributors, while businesses with a higher turnover, those in regional Australia, and operators in the steel and metal and technology sectors are the most optimistic.

Food & Beverage Focus

As Australia’s largest manufacturing sector, food and beverage producers and distributors play a vital role in supporting the Australian economy.

Encouragingly, most have navigated an operating environment marked by higher costs, constrained skills, and fluctuating customer demands by prioritising productivity.

That has provided a strong foundation for growth in 2024, supported by planned investment in new technologies, skills and sustainable practices.

Growth trajectory

More than two in three food and beverage manufacturers and distributors grew revenue or profit in 2023. Most lifted production output and increased prices amid inflationary conditions and rising costs. With fewer able to expand their workforce in a tight labour market, this suggests efficiency gains were in sharper focus.

These trends are set to continue in 2024.

Fixed costs are expected to remain elevated, with around three in four anticipating higher energy costs and persistent inflation to have a medium to high impact.

Specifically in response to inflationary conditions, 52 per cent of food and beverage manufacturers and distributors are planning to improve productivity and internal cost controls, 43 per cent to innovate with cost-effective products, and 43 per cent to increase prices.

Most are also forecasting a rise in production, revenues, and profit in the year ahead, and there are early signs that prices may normalise.

This is supporting confidence across the sector, with 84 per cent optimistic about conditions in 2024.

Skills, systems to boost productivity

Food and Beverage manufacturers and distributors were most likely to cite constrained access to labour and skills, as well as ineffective operating systems, as a drag on productivity.

Despite these challenges, one in two are operating at 85 per cent or more of their maximum capacity (see graphic below), with most others achieving a 75-84 per cent capacity utilisation rate.

Considering many food and beverage manufacturers and distributors are planning to increase output again this year, initiatives and investment in supply chain efficiencies, technology and digital skills are in focus.

Emerging technologies

Almost nine in 10 food and beverage manufacturers and distributors plan to increase technology investment in 2024, including 30 per cent that will significantly extend their digital spend.

There is broad agreement that emerging technologies hold productivity benefits, with businesses also striving for increased financial performance and customer experience improvements. Again, in the absence of existing skills, the cost and time to upscale staff on new technologies is seen as the top barrier.

Balancing efficiencies, environmental impact

Almost all food and beverage manufacturers and distributors have implemented at least some practices to improve environmental sustainability, although they are at varying stages of maturity.

The top drivers of sustainability initiatives include operational efficiencies, cost reduction and an increased competitive edge, while the top obstacles are financial constraints, supply chain complexities and operational disruptions.

While using recycled materials, reducing operational waste, and renewable energy are the most commonly adopted practices, the fastest-growing initiates are expected to be:

- establishing teams to manage upcoming regulatory frameworks and requirements (49%);

- implementing sustainable procurement processes across supply chain (48%);

- reducing energy usage and driving energy efficiency (46%); and

- collaborating with external organisations on sustainability projects (46%).

Just 31 per cent of food and beverage manufacturers and distributors have a good understanding of incoming mandatory sustainability reporting requirements, while 43 per cent have some understanding.

Once implemented, 44 per cent of businesses anticipate that added compliance and resource allocation will increase the cost of doing business, while 42 per cent believe mandatory reporting will increase investment in ESG initiatives, which is higher than in other sectors.

Most manufacturers and distributors are striving to at least moderately increase production volumes and revenue growth in the year ahead while managing margins. If realised, this will extend the uplift in output and performance last year.

However, achieving this relies on navigating cost pressures and optimising productivity in step with demand. Amid a skills and labour shortage, manufacturers and distributors are doubling down on investment that can modernise the skills, systems and equipment required to deliver a competitive edge.

The CommBank Manufacturing Insights research is based on a survey of 464 manufacturers and distributors to gauge current and future financial and operational performance drivers to support decision-makers as they develop their growth strategies. For more information and your copy of the full report, visit commbank.com.au/manufacturing.

This article first appeared in the June/July 2024 edition of Food & Drink Business magazine.