Since Mark Post first introduced his cultured meat burger in 2013, the industry has attracted nearly US$3 billion in private investment. In that time, over 150 incredible founders have established new companies, developing innovative food products by leveraging cell biology and advanced biomanufacturing techniques.

To date, four of those companies have received regulatory approval to sell their products, and three have successfully brought those products to market. Most recently, Vow, a Sydney-based company, has begun selling Japanese Quail parfait in Singapore.

Despite these milestones, the journey has not been without its challenges. In the past six months, we have observed a significant reduction in venture capital funding for many start-ups in this sector. With investors (seemingly) preferring to wait and see how the existing companies tackle the three big challenges: getting products to market, building consumer demand, and effectively scaling.

Additionally, several products have been withdrawn from the market as companies re-evaluate their scaling strategies. This has sparked online debates about the long-term viability of cultured meat, and several voices have even called for a pre-emptive ban on cultured meat. However, critics of the cultured meat industry may be missing the broader picture.

Cultured meat represents more than an alternative food source; it is a driving force behind some of the most notable advancements in biomanufacturing over the last decade.

Even if cultured meat does not fully penetrate mainstream markets, its innovations will continue to influence the biotechnology sector for years to come.

Consider the following breakthroughs in the last five years alone:

- Cost Reduction: The cost of recombinant growth factors, essential for large-scale biomanufacturing, has decreased by more than 100-fold. This reduction has significantly lowered the cost of necessary growth media.

- Media Formulations: There has been significant progress in developing publicly available chemically defined media formulations for skeletal muscle cells. These advancements are crucial for the cells' growth and development, facilitating more cost-effective and consistent research, particularly in academic settings.

- Bioreactor Innovation: The introduction of cutting-edge bioreactor designs has transformed the process of culturing cells in high densities and on a large scale, crucial for both cultured meat production and cell therapy applications.

- Bioprocessing Software: Advances in bioprocessing software have enhanced capabilities for tracking, predictive modeling, and improving the yield of final cell products.

A surprising trend recently is the reluctance to invest in pre-seed and seed-stage cultured meat companies. The industry is perceived as saturated, with investors adopting a 'wait and see' approach to see how established companies overcome key challenges such as market entry, consumer demand generation, and scaling.

While this caution is understandable, it may represent a missed opportunity given the advantages that newer companies might leverage.

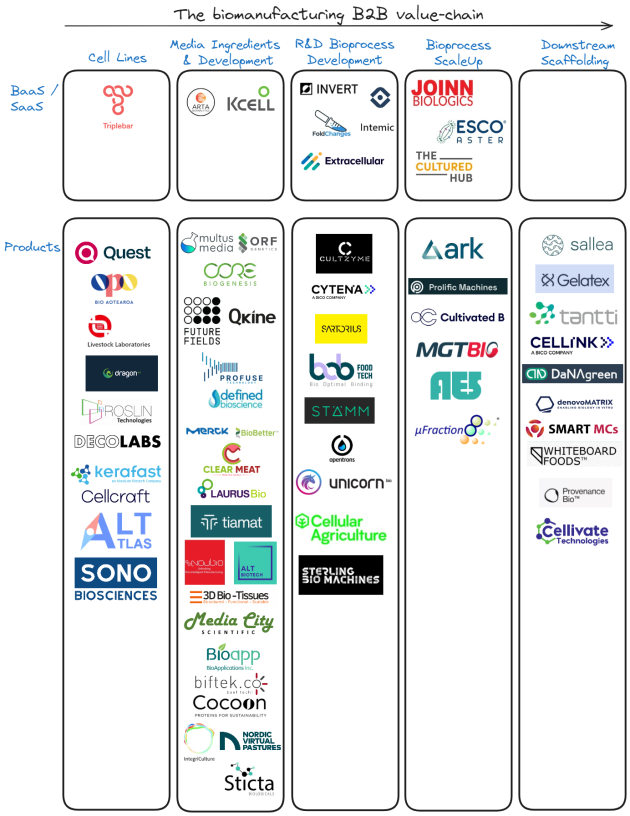

Today's cultured meat startups are in a far more advantageous position than their predecessors. Just five years ago, the necessary infrastructure was practically non-existent, and companies had to develop everything from scratch at great cost. However, in 2024, a B2C cultured meat company can acquire or license nearly all essential components from the start, shifting the value from in-house development to strategic assembly of these elements.

Companies that can effectively link these blocks together so that the sum is greater than the parts will likely have a tremendous advantage and could rapidly catch or surpass those that are near market.

To highlight this, I have outlined an end-to-end value chain for B2B companies, not only within cultured meat but applicable to any bio-manufactured product. This rapidly evolving infrastructure is a testament to the industry's growth and potential.

I’m truly excited about the future of cultured meat and even more so for the incredibly cool technology that’s being developed to support this growing industry. Rumours of its death are much exaggerated; the cultured meat revolution has only just begun!

James Ryall is a life sciences and biotech consultant and honorary research fellow at The University of Melbourne. He can be reached here.